If you’re an ISV, you’ve likely been hearing terms like Payment Facilitator (PayFac) or PayFac as a Service floating around the software industry. The buzz around these terms has increased the demand for ISVs to be able to gain greater control over payment processing, enhance customer experience, and own all the revenue that comes with digital payments. On paper these benefits are clearly desirable, but does that mean becoming a true Payment Facilitator is right for you?

To shed light on the complex journey to becoming a PayFac, we recently hosted a webinar titled “The Road to PayFac”, where we had a panel discussion with vertical software leaders on their experience navigating payment partnerships.

The event was led by Jean Boling, ISV Business Developer for Clearent, who was accompanied by Tyler Barefoot, the Payments Program Manager of Dental Intelligence, and Tom Beidle, the CEO of Xplor Spot.

Key Webinar Takeaways

While we encourage you to watch the webinar replay to get the full picture on scaling your business with payment partnerships, here’s a quick summary of the takeaways.

Key Considerations When Seeking Payment Partnerships

Jean opened the webinar by addressing the overarching problem, “Everyone wants to be a Payment Facilitator, but is it the right decision for your software business?”. For most software companies, a payments partnership is the fastest way to realize the benefits of integrated payments. This is where the value of a payment partner comes into play. The right partner will seek to truly understand your needs, and work with you to pick the right path to payment monetization so you can realize your revenue goals and scale your business faster.

Make sure you’re considering the following points when evaluating a payments partnership:

- Type of partnership

- Partnership and solution needs

- Understanding the costs and risks of each model

- Your boarding speed needs

- Growth and scalability goals

- Does it fit your branding needs

Payment Partnership Models & Embedded Payments

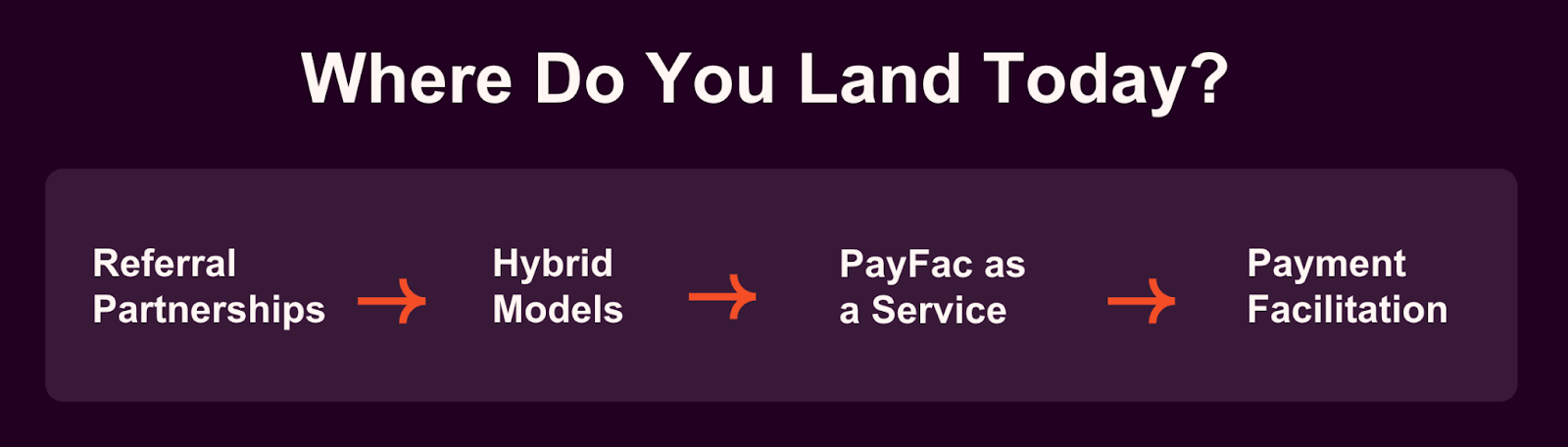

From key considerations Jean moved into briefly explaining the core partnership models that ISVs leverage today, including, referral, hybrid, PayFac as a Service, and payment facilitator models.

Panel Discussion with Dental Intelligence & Xplor Spot

Now that the stage has been set, the real value comes out. We were fortunate enough to be accompanied on this webinar by two vertical software and payment experts, Tyler Barefoot of Dental Intelligence and Tom Beidle of Xplor Spot.

Each of these partners have faced different payment challenges over the years and with those compounded experiences have valuable insight into navigating the payments landscape successfully.

We prepared the below questions for our panelists to tap into their experiences along the way:

- What partnership types have your company utilized?

- Were you interested in the payment facilitation path?

- What level of payments were you searching for when seeking a payment partner?

- What solution and partnership type are you using with Clearent and why?

- How has payment partnership played a role in your company’s success?

In this discussion our speakers dove deep into the importance of doing ample research to understand your company’s legitimate payment needs, your goals, and the capabilities your company has today. From there ISVs can better identify the best fitting path to success today and also allow them to achieve their goals overtime.

Why Watch This Webinar?

Understanding your partnership and payment needs is essential to the success of your software and your users’ success. Our webinar offers a valuable opportunity to hear from vertical software leaders that have experienced multiple variations of embedded payments models. By watching, you’ll get first hand insights into which partnership model is right for you right now and how to scale to more lucrative models.

Watch the webinar replay here: The Road to Payment Facilitation

Article by Clearent by Xplor

First published: April 05 2024

Last updated: May 30 2024