Our recent webinar, Balancing Risk & Reward with PayFac as a Service, provided invaluable insights into how software providers can maximize every aspect of software embedded payments revenue. Hosted by Nick Campbell, Chief Product Officer at Xplor Pay, the session explored how businesses can leverage PayFac as a Service (PFaaS) to strike their desired level of embedded payments control while maximizing revenue and mitigating risk.

The webinar highlighted four core pillars software providers should focus on—maximizing attach rates, increasing wallet share, minimizing cost to serve, and optimizing portfolio performance. This recap summarizes the actionable strategies designed to help software providers navigate the complex world of payments while driving sustainable growth.

Balancing Risk & Reward with PayFac as a Service

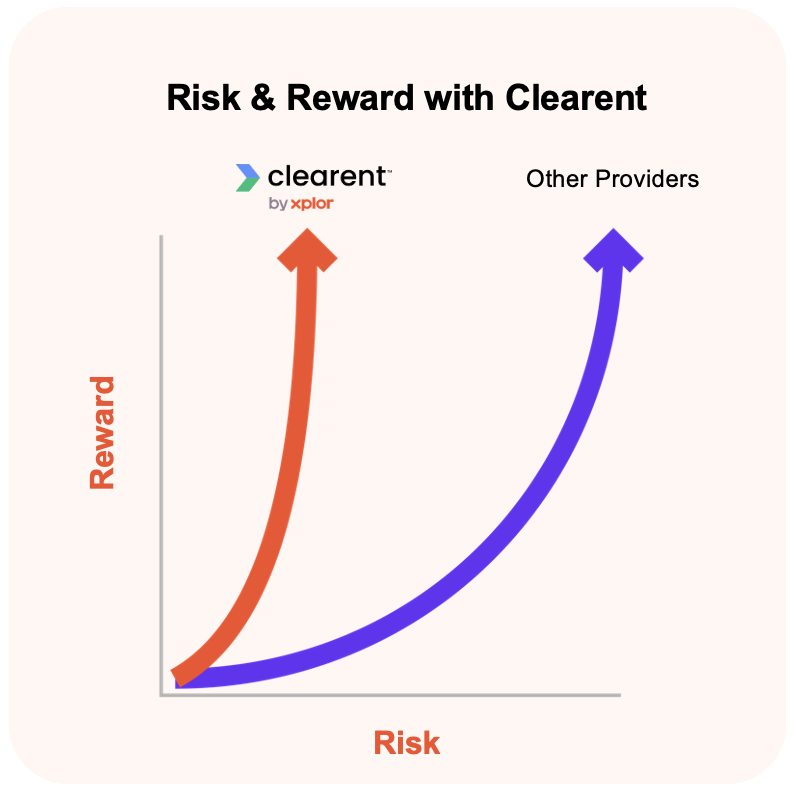

What Does it Mean to Balance Risk & Reward with PayFac as a Service?

Before diving into the core pillars, Nick started off by demystifying what it means to balance risk and reward with PayFac as a Service.

So, what does it mean?

Finding your balance means assessing your risk tolerance, resources, challenges and overall payments revenue goals.

Why is this important?

Through years of experience executing embedded payments strategies for software partners and 15 owned business management systems (BMS), we’ve learned that there is no one size fits all approach. However, many providers take this approach, leaving software vendors with a list of challenges that prevent them from tapping into their full revenue potential.

Do any of these challenges sound familiar?

- Leaving revenue on the table

- Not receiving a full breakdown of the costs & risks needed to scale

- Lack of real partnership support & guidance

- Confusion around what solution is best for your business

4 Core Pillars of Embedded Payments Revenue

Working through the challenges above with a partner that supports the balance of risk and reward you want to achieve helps generate sustainable revenue growth from your payments program. This means more revenue from higher attach rates, healthy margins and a reliable service model.

1. Maximize Payment Attach Rates

In the webinar, Nick emphasized how maximizing attach rates ensures that your embedded payments solution works for you, unlocking revenue potential with every transaction. Attach rates, sometimes referred to as payment adoption rates, are a critical driver of revenue growth for software platforms.

Just consider, you spend all this time and money standing up a payment integration but are struggling to drive merchants to adopt the new payments integration within your software platform.

Nick then shared compelling examples of how we helped two of our owned BMS platforms, Xplor Spot and FieldEdge, who increased payment attach rates to 80% and 95%, respectively.

To get the full story, access the full recording here: Balancing Risk & Reward with PayFac as a Service Webinar

2. Maximize Share of Wallet

Maximizing wallet share means capturing a larger portion of your customers’ payment processing needs, driving more transactions through your platform. During the webinar, Nick emphasized that a tailored approach to payment workflows is essential to achieving this. By analyzing the full spectrum of payments, from card-not-present (CNP) to card-present (CP) transactions, businesses can integrate payment solutions that maximize wallet share across all customer touchpoints.

An example from the dental industry highlighted this strategy in action. Clearent partnered with a patient engagement system that was already seeing over 90% attach rates, yet only capturing a small fraction (5%) of the total payment volume processed by dental offices. Patients typically paid in person, which meant that payments were processed through separate practice management systems, bypassing their engagement system.

We made a simple adjustment that dramatically increased payment volumes, from $1,500 to $33,000 per month, while also lowering transaction costs through card-present interchange rates.

To get the full story, access the full recording here: Balancing Risk & Reward with PayFac as a Service Webinar

3. Minimize Cost to Serve

Minimizing the cost to serve is crucial for maintaining profitability while delivering high-quality payment solutions. During the webinar, Nick discussed how Clearent’s API-first technology, combined with a deep partnership approach, and dedicated partner support, enables SaaS platforms to embed payments in a way that is both cost-effective and scalable. By aligning payment solutions with a business’s growth trajectory, Clearent ensures that platforms can grow efficiently without incurring excessive costs.

One example is a long-term automotive partner that started with a simple semi-integrated hardware solution. As their platform grew, they added advanced features like text-to-pay, email payments, and electronic check acceptance, reducing operational costs while meeting customer demands.

4. Optimize Portfolio Performance

Optimizing portfolio performance is about continuously monitoring your portfolio to ensure your software platforms not only drive revenue but also operate efficiently, with a focus on maximizing profitability. During the webinar, Nick highlighted the importance of leveraging reporting tools to gain deeper insights into payment performance and identify areas for improvement.

Clearent’s reporting API allows SaaS partners to retain customers within their platform while accessing detailed transaction data. For example, a healthcare partner used the interchange report to find downgrades in transactions caused by missing Level 2 data for HSA cards.

After working with our Integration Support team to add the required fields, the partner saved $84K annually, improving both payment efficiency and overall portfolio performance.

To get the full story, access the full recording here: Balancing Risk & Reward with PayFac as a Service Webinar

Wrapping Up.

Overall, the Balancing Risk & Reward with PayFac as a Service webinar provided software providers with actionable strategies to enhance their embedded payments approach. From maximizing attach rates and wallet share to minimizing the cost to serve and optimizing portfolio performance, the insights shared by Nick highlighted the immense potential of PayFac as a Service (PFaaS) to drive sustainable growth and profitability.

At Clearent, our solutions don’t put you in a box; we meet you where you are today and offer consultative guidance to help you scale your revenue goals. We encourage you to watch the webinar to hear more about our approach.

Want to start maximizing your embedded payments revenue as soon as possible?

Schedule time with one of our payments consultants.

by Clearent by Xplor

-

First published: September 20 2024

Written by: Clearent by Xplor