Visa introduced the Fixed Acquirer Network Fee (FANF) in April 2012.

The FANF fee is a monthly fee that is assessed on a merchant taxpayer basis and includes all merchant accounts owned by a business for credit card transaction processing.

This fee can be quite confusing to figure out, so we will do our best to explain how it is calculated.

The amount of the FANF depends on the merchant category code (MCC), the mix of card present and card not present volume, and the number of locations the business operates. The FANF can vary from month to month for each merchant depending on these factors.

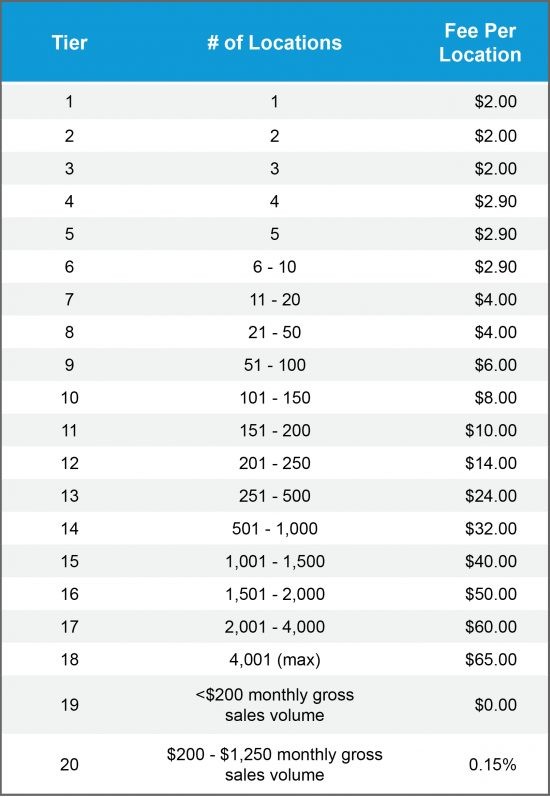

For many merchants who process all of their transactions in a card present environment, the amount of the FANF is based on the number of locations owned by the business, as shown in Table 1b below. (Please note that if merchants have any card not present volume for debit and credit card processing, they will incur additional FANF fees, which we will explain later.)

Visa modified the FANF in April 2015 so that payment facilitators were no longer permitted to aggregate taxpayer IDs and volume, meaning each taxpayer must be reported and billed individually. In addition, Visa reduced FANF rates for merchants with very low sales volume.

Table 1a: Card Present (excluding High Volume MCCs)

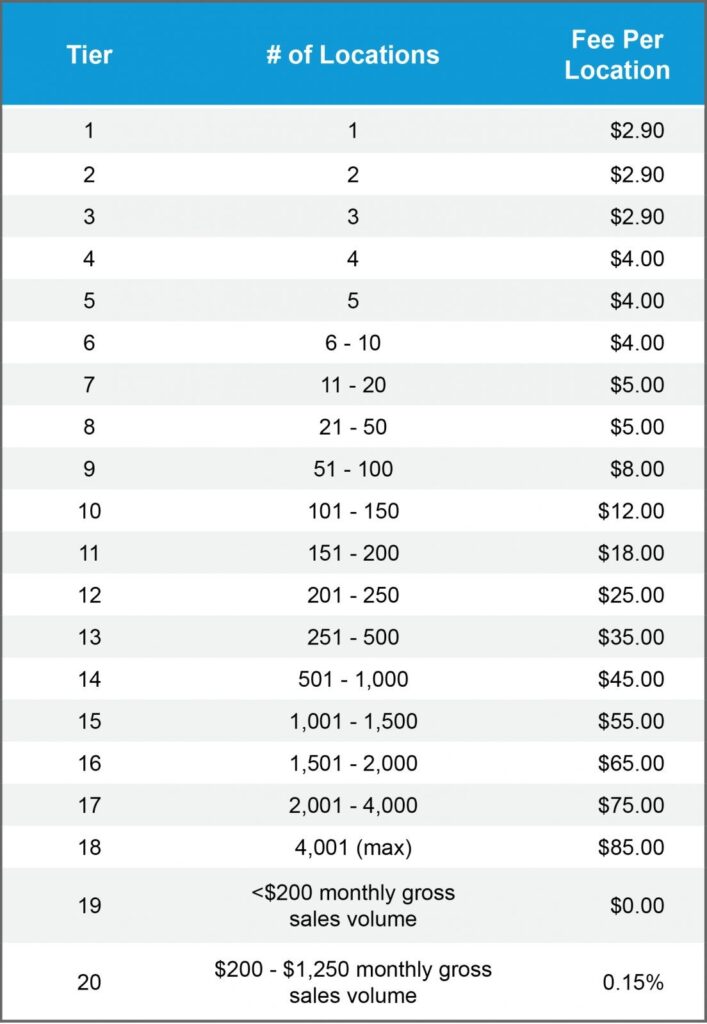

However, certain types of merchants are considered “High Volume MCCs” by Visa and have a different set of rates shown in Table 1a below. High Volume MCCs include Airlines (3000-3299, 4511), Auto Rental (3300-3499, 7512), Lodging (3500-3999, 7011), Warehouse Stores and Wholesale Clubs (5200, 5300), Discount Stores (5310), Department Stores (5311), Supermarkets (5411), Car/Truck Dealers (5511), Auto Tire Stores (5532), Petroleum (5541, 5542), Family Clothing Stores (5651), Furniture Stores (5712), Electronic Stores (5732), Drugstores (5912), Theatres (7832) and others.

Table 1b: Card Present High Volume MCCs

Now comes the really tricky part – card not present volume. The FANF fee for card not present volume is calculated separately in Table 2, in addition to the fee from Table 1a or 1b. The FANF fee for card not present volume is based on monthly volume, as shown in Table 2 below.

This table is also used to determine the FANF for fast food restaurants (MCC 5814) and unattended terminals.

Table 2: Card Not Present, Fast Food Restaurants, Unattended Terminals

As a reminder, the FANF is calculated per merchant taxpayer and includes all merchant accounts owned by that taxpayer. A taxpayer is defined as a legal business entity with its own federal taxpayer identification number (TIN).

This can make it even more confusing, so hopefully, the following examples will help you understand it.

Example #1: Retail business with one merchant account with 100% card present volume

- Shoe store (MCC 5661) with one location

- One merchant account that processes all $5,000 of monthly Visa volume as card present

FANF is determined using Table 1b, Tier 1 = $2.00/month.

Example #2: e-commerce business

- Sells t-shirts online

- One merchant account that processes $10,000 of monthly Visa volume, all card not present

FANF is determined using Table 2, Tier 5 = $15.00/month.

Example #3: Restaurant with one location with 80% card present volume

- Pizza parlor (MCC 5812) with one location

- One merchant account that processes $8,000 card present plus $2,000 card not present (for delivery orders)

The FANF is determined in two steps. The card present volume is determined using Table 1b, Tier 1 ($2.00). The card not present volume is based on Table 2, Tier 3 ($7.00). So, the total FANF for this account would be $9.00 per month.

Example #4: Retail business with multiple locations and channels

- Shoe store (5661) with two locations and an e-commerce website

- Location A has its own account and processes $5,000/month, all card present

- Location B has its own account and processes $7,500/month, $5,000 of which is card present

- The e-commerce website has its own account and processes $5,000/month, all card not present

The card present part of the business is based on Table 1b, Tier 2 (2 locations), so each location is assessed $2.00/month. The card not present part combines the volume from Location B and the e-commerce website. The total of $7,500 in card not present volume results in Table 2, Tier 4 or $9.00 per month.

While the FANF is calculated per taxpayer across all of the businesses’ merchant accounts, Clearent bills the appropriate amount to each merchant account. In the case of Table 2 fees, Clearent will prorate the fee across each account by volume. In Example #4, each account would be billed as follows:

- Location A – $2.00

- Location B – $5.00 ($2.00 + $9.00 * $2,500/$7,500)

- E-commerce – $6.00 ($9.00 * $5,000/$7,500)

Clearent merchants will see two line items on their statement if the account has both card present and card not present volume (e.g., Location B in the above example).

For additional information, visit Understanding Interchange and Visa Transaction Integrity Fee pages.

Article by Clearent by Xplor

First published: August 31 2023

Last updated: December 13 2024