Payment processing fees are an inevitable aspect of conducting business. However, for small business owners, these fees can quickly add up and eat into profits. To alleviate the impact of processing fees, many businesses are turning to cash discounting and surcharging strategies. Here, we explore the best practices for implementing these strategies effectively, understanding the importance of the legal landscape around these strategies, while maintaining positive customer relationships.

Understanding Cash Discounting & Surcharging

Before diving into best practices, let’s clarify the concepts of cash discounting and surcharging:

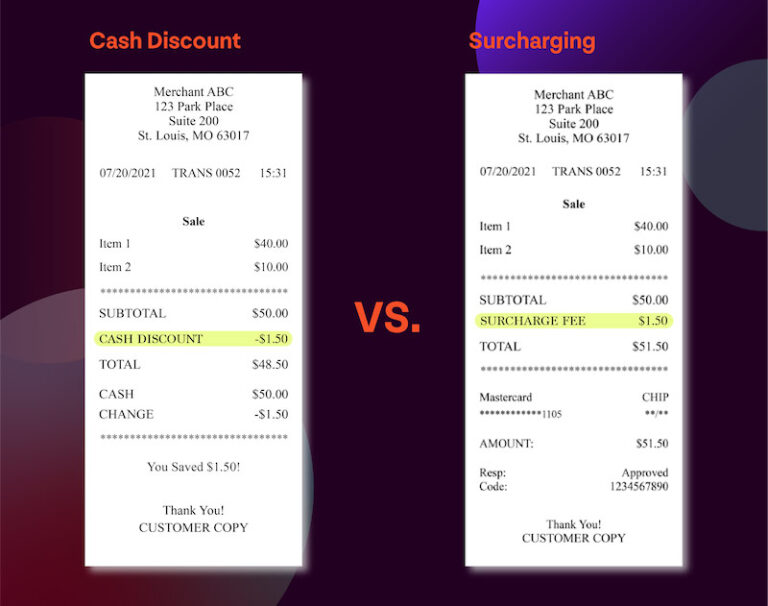

- Cash Discounting: A practice where businesses offer a discount to customers who pay with cash, check, or in-store gift card instead of using a credit or debit card. This discount is essentially a way to incentivize customers to use payment methods that do not incur processing fees, helping the business save money.

- Surcharging: In contrast, surcharging involves adding a fee to transactions made with credit cards to offset processing costs. This fee is typically a percentage of the transaction amount and is disclosed to customers before they make a purchase. This practice is not legal in all areas, so it’s crucial to understand the regulations in your region before implementing it.

Best Practices for Implementing Cash Discounting & Surcharging

- Know the Law:

Implementing cash discounting and surcharging requires a strong understanding of the legal landscape, given the significant variation in laws and regulations across different jurisdictions. It’s critical for businesses to stay informed about state-specific regulations, as some U.S. states impose restrictions or outright bans on surcharging. Additionally, credit card networks such as Visa, Mastercard, and American Express have their own guidelines that dictate how surcharges can be applied, including limits on the surcharge amount and requirements for customer notification.

The legal landscape for payment processing fees is not static. Laws can change due to legislative actions, court decisions, or shifts in policy by credit card networks. Staying informed means actively monitoring these sources for any updates that might affect your business. Subscribing to newsletters from legal advisories, financial institutions, and industry associations can keep you ahead of these changes.

- Be Transparent

With cash discounting, ensure that the discounted price for cash payments is displayed as prominently as the credit card price. This can be done with well-placed signage at the point of sale and clear markings on price tags in physical stores. The goal is to simply make the customer aware of the potential savings.

For surcharging, clarity is equally important. The additional cost for using a credit card should be communicated before the transaction begins — not just at the checkout but also through visible notices within the store and on the payment page of your website. Ensure the surcharge is a separate line item on the receipt, so there’s no ambiguity about the charge.

Beyond signage and digital notices, customer-facing staff should be equipped to handle inquiries regarding price differences. They should be able to articulate why the business has chosen to implement these practices and how it benefits both the customer and the business.

You should leave no room for customer confusion. Providing all necessary information in a straightforward manner reinforces the value of choosing one payment method over another and encourages informed purchasing decisions.

- Offer a Variety of Payment Options:

Offering multiple payment options is essential in retail to accommodate customer preferences. Even when using cash discounting and surcharging to manage costs, businesses should still accept a range of payment methods. This includes traditional credit and debit cards, as well as modern options like digital wallets and electronic bank transfers. By providing these choices, businesses show a commitment to customer convenience and service, fostering satisfaction and loyalty. Keeping up with emerging payment technologies can also position a business as a market leader, ensuring that no customer is alienated by a lack of payment options.

- Leverage Technology:

Leveraging technology to execute cash discounting and surcharging pricing programs can streamline operations and increase the accuracy of transactions. Investing in modern point-of-sale (POS) systems that are equipped to handle both of these pricing strategies can vastly improve efficiency. These systems can be programmed to automatically adjust pricing based on the payment method selected, ensuring that cash discounts are applied correctly and that surcharges for credit card transactions are calculated in compliance with applicable laws and regulations.

Additionally, sophisticated POS systems can simplify the checkout process for both customers and staff. They reduce the potential for human error in manual calculations and ensure consistency in pricing across the board. This not only builds trust with customers—who can see that discounts or fees are being applied systematically—but also helps with record-keeping and financial reporting. With accurate tracking of how discounts and surcharges impact sales and profitability, businesses can make more informed decisions about their pricing strategies.

- Monitor Customer Feedback:

Listen carefully to what customers say about your pricing; this feedback is a valuable measurement of their satisfaction. When you notice patterns of concern or dissatisfaction, be ready to make swift adjustments. Addressing feedback not only optimizes the pricing structure but also signals to customers that their voice matters, fostering loyalty and encouraging repeat business. - Adjust as Necessary

Being adaptable is key when it comes to your business’s pricing strategies. Keep an eye on changes in legal regulations related to cash discounting and surcharging, ensuring your practices comply with the latest laws. Customer feedback is equally important. If there’s a trend in negative responses to your pricing approach, be ready to adjust. This might mean altering the discount percentage or the surcharge amount.

Operational efficiency is also part of the adjustment process. If implementing your pricing strategy causes bottlenecks at checkout or complicates the transaction process, it may be time to streamline operations. Additionally, stay aware of what competitors are doing and the general market trends to ensure your pricing remains competitive.

Maintain flexibility in your strategies to navigate the fine line between managing costs effectively and keeping your customer’s content. Regular reviews and a willingness to change course are essential for sustained success

Wrapping Up

Navigating the complexities of cash discounting and surcharging requires a blend of legal awareness, clear communication, and flexibility. By understanding and adhering to the relevant laws, maintaining transparency with your customers, offering a variety of payment options, leveraging technology for efficiency, and being responsive to customer feedback, businesses can craft a strategy that meets legal standards with an optimized checkout experience that improves profitability.

This layered approach not only helps in managing the financial impact of processing fees but also ensures that customers remain informed and appreciated. Remember, the goal is to create a transparent, efficient, and customer-friendly environment that encourages repeat business and nurtures a positive reputation. By staying adaptable and customer-focused, businesses can turn the challenge of processing fees into an opportunity for growth and customer loyalty. Keep refining your practices, listening to your customers, and adjusting as necessary to maintain the delicate balance between profitability and customer satisfaction.

Ready to see how Clearent by Xplor can help you decide if Cash Discounting or Surcharging is right for your business?

by Clearent by Xplor

-

First published: April 12 2024

Written by: Clearent by Xplor