If you are a software company that has already started leveraging payments within your software, or if you are just beginning your journey, you have likely noticed the terms integrated payments and embedded payments. With these terms seemingly used interchangeably, we have noticed confusion building in the SaaS and payments landscape.

In this blog, we define the similarities and differences between these payment models and discuss the pros and cons so that ISVs can be better informed on which is best for their business today.

The Similarities Between Integrated and Embedded Payments

At the foundation, integrated and embedded payments both aim to enhance the efficiency and user experience of SaaS platforms. They both utilize a payment provider to simplify payment acceptance and improve customer satisfaction and retention. Additionally, each model offers potential revenue growth through streamlined operations and transaction fee opportunities, making them attractive options for platforms looking to optimize their payment processes.

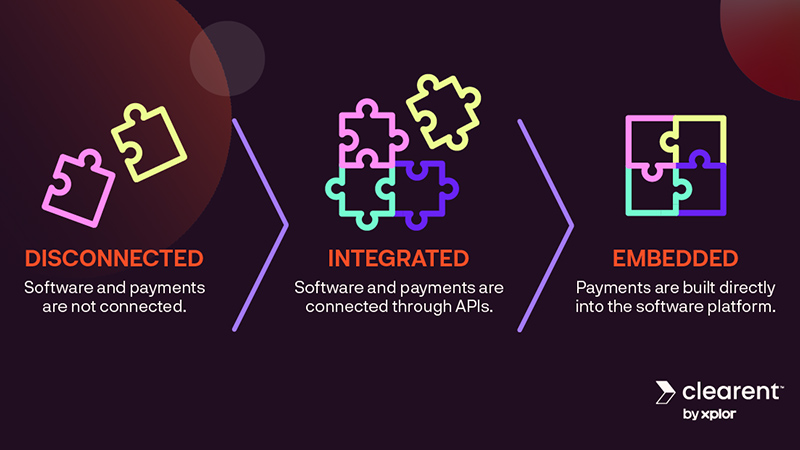

The Difference Between Integrated and Embedded Payments

Before we define these terms, let’s jump right into summarizing the core difference between embedded and integrated payments. The most notable differences lies in control and user experience. With embedded payments, the ISV has full control over how their merchants are managed. Payments are a seamless part of the user experience, and the ISV has the power to offer flexible pricing that can drive revenue.

Unlike embedded payments, integrated payments are managed by a third party. The end result is a less cohesive payment process, which may disrupt the user experience. The ISV has limited control over pricing, which impacts profitability and product adoption.

What are Integrated Payments?

Integrated payments refer to a streamlined approach where payment processing systems are directly connected with a software platform’s existing operations. This method utilizes APIs (Application Programming Interfaces) and SDKs (Software Development Kits) to facilitate smooth communication between the platform and the payment systems, ensuring that financial transactions are seamlessly incorporated into the business’s broader digital ecosystem.

Pros and Cons of Integrated Payment Systems

Pros

Simplified Operations: Integrated payments automate the flow of financial data across systems, reducing manual data entry and decreasing the likelihood of errors, which in turn enhances operational efficiency.

Improved Customer Experience: By keeping all payment processes within the platform without redirecting users to external sites, integrated payment systems offer a smoother way to accept payments, creating a better user experience and contributing to higher customer satisfaction and retention.

Scalability: As business needs grow and evolve, integrated payments can easily scale to handle increased transaction volumes and adapt to new operational demands.

Cons:

Limited Control Over the Payment Process: Since this model often relies on third-party providers for payment processing, software companies may have less control over the user experience and the customization of payment services.

Dependence on Third-Party Providers: Software companies integrating payments have a reliance on external payment providers can introduce risks related to service disruptions, data privacy, and security vulnerabilities.

Potential for Integration Challenges: Integrating multiple systems can sometimes lead to technical difficulties, especially if the existing software and the payment systems are not fully compatible.

Integrated payment solutions offer a balanced approach for software companies looking to enhance their payment operations without the complexities of managing these systems entirely in-house. However, the choice between adopting an integrated approach or opting for an alternative payment solution should be guided by specific business needs, technical capabilities, and customer engagement strategies.

What are Embedded Payments?

Embedded payments are a sophisticated financial technology that integrates payment processing capabilities directly within a software platform. This approach allows transactions to be conducted seamlessly within the platform’s environment, creating a unified and intuitive user experience. Unlike traditional payment methods that may redirect users to external systems, embedded payments make the financial interaction appear as a natural part of the platform’s workflow.

Embedded payments are not merely added to a platform; they are intricately woven into the application’s fabric, ensuring that the payment process aligns perfectly with the user’s journey and the platform’s core functionalities. This deep integration helps maintain a consistent brand experience and enhances customer trust by minimizing disruptions during transactions.

Pros and Cons of Embedded Payment Solutions

Pros:

Enhanced User Experience: Embedded payments provide a seamless and intuitive payment process, significantly improving the overall customer experience. The integration ensures that users don’t have to leave the platform to complete transactions, reducing friction and potentially increasing conversion rates.

Greater Control Over the Payment Experience: With embedded payments, companies maintain complete control over the payment process, including customization of the payment interface and merchant onboarding. This control extends to all aspects of the payment experience, from security measures to customer service, allowing for a tailored approach that reflects the platform’s brand.

Increased Revenue Opportunities: By managing the payment process internally, platforms can directly monetize their payment services, setting their own pricing and potentially increasing their profit margins through additional fees or premium service offerings.

Cons:

Higher Resource Requirements: Implementing an embedded payment solution requires significant resources, including development time and expertise. Companies must be prepared to invest in technology development and potentially deal with regulatory compliance issues.

Operational Complexity: Managing an entire payment system internally increases the complexity of business operations. This includes handling customer inquiries, resolving disputes, and ensuring compliance with financial regulations, all of which require dedicated staff and systems.

Risk Management: With embedded payments, the platform assumes greater responsibility for fraud detection and security. This can be a double-edged sword, as it provides more control but also places the burden of managing these risks directly on the company.

Embedded payment solutions offer significant advantages in terms of user experience and revenue generation but come with increased responsibilities and operational demands. For companies considering this model, weighing these pros and cons is crucial to determine if the benefits align with their strategic goals and operational capabilities.

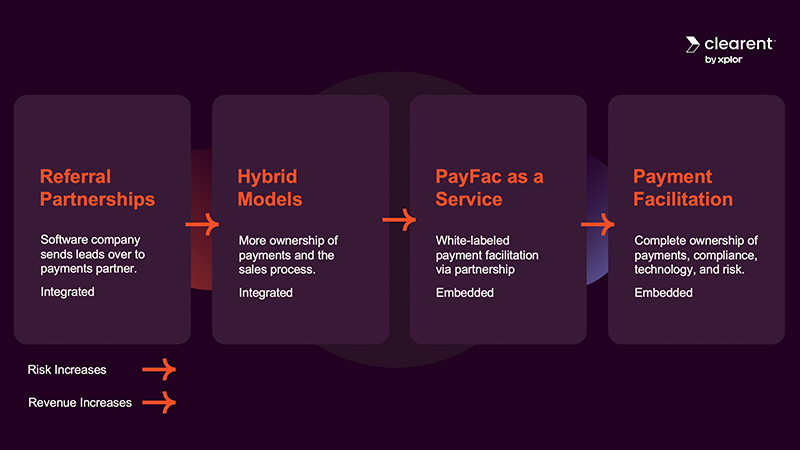

Understanding Payment Partnership Models for Integrated Payments vs Embedded Payments

To have a truly embedded payment system, software companies would want to become a payment facilitator, but in many cases that is not feasible. So what are your options? Partnering with a company like Clearent could be your next step. In this section, we highlight the partnership models that correlate to integrated and embedded payments.

Integrated Payments Partnership Models

Referral Partnerships: Common in integrated payments, platforms refer users to third-party providers, earning a referral fee while outsourcing the sales, onboarding, and activation to merchants.

Hybrid Partnerships: A step beyond referral, this model integrates payment processing into the platform’s operations with increased ownership of payments and the sales process.

Embedded Payments Partnership Models

PayFac as a Service: A balance between control and ease, this model integrates payment processing into the platform’s operations while leveraging pre-built compliance and security infrastructure from a payments provider.

Payment Facilitator (PayFac) Model: Platforms take full control of the payment process, including compliance and merchant onboarding, maximizing revenue but requiring significant investment.

Related Articles:What ISVs Should Look For In A Payments Partner?

Wrapping Up

In this discussion, we’ve examined the key differences and similarities between integrated and embedded payments, emphasizing their impact on software companies. Integrated payments offer simplicity and are suitable for smaller companies or those needing quick implementation, while embedded payments provide greater control, enhancing customer experience and revenue opportunities through deep integration.

Choosing the right payment model is critical for the growth and customer satisfaction of a SaaS platform. This decision should align with your company’s size, resources, compliance requirements, and long-term goals. The appropriate payment model can dramatically affect your platform’s ability to innovate and compete, ultimately influencing its success in the dynamic SaaS market.

Article by Clearent by Xplor

First published: May 14 2024

Last updated: May 30 2024