Integrating payments into your software app adds value for your users, gives you more control over payments and creates new lines of potential revenue. SaaS companies have a few options for how to integrate payments, though each comes with its own pros and cons. Wouldn’t it be great to take what you want from each in order to get all the benefits and avoid all the potential risks?

Take a closer look at why a Hybrid Payment Facilitator (PF) model may be your smartest choice.

Hybrid Model Benefit – 1

Less Risk

Payment facilitators take on primary liability for sub-merchants’ processing accounts. For example, if a sub-merchant can’t pay for a chargeback or is stolen from or hacked, the PF is on the hook for those charges. If the PF boards a fraudulent merchant, they are responsible for those losses. Managing all of these risks, and handling disputes and source documents can be overwhelming. In a hybrid model, your payments solutions provider takes on a majority of the security risk, underwriting burden, fraud liability, and PCI DSS compliance, effectively reducing your overall risk.

Hybrid Model Benefit – 2

Greater Profit Potential

Payment Facilitators earn 100% profit on every amount over the cost to process payments. So, if a SaaS provider’s cost to run a transaction is 2.5% of the transaction amount and they sell payment processing at a flat 3.0% rate, they earn an additional .5% on each transaction. For PF’s with a very large customer base, that becomes a substantial revenue generator. But for SaaS companies with a smaller customer base, the costs will likely be greater than the potential revenue. With a hybrid PF model, you can still control how you price payments processing to your customers and generate significant revenue with far fewer costs. This results in greater profits.

Hybrid Model Benefit – 3

Lower Cost

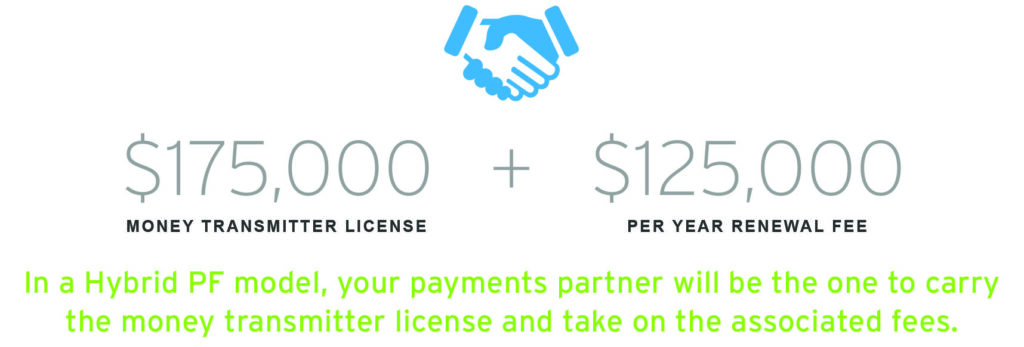

Becoming a payment facilitator requires significant upfront investments (particularly payments for different certifications, financial guarantees and requirements to be underwritten as a PF.). A hybrid model reduces your investment of time and capital, and requires fewer staff and operational specifications. That’s because your payments partner handles the majority of requirements. PF’s that accept processed funds from a consumer for the purpose of sending or transmitting those funds to the sub-merchant are at high risk of being labeled as a money transmitter under most state definitions. Why does this matter? Companies regulated as money transmitters are subject to hefty compliance obligations. The initial cost for a Money Transmitter license is $175,000 with a $125,000 per year renewal fee. Failure to comply can result in both civil and criminal penalties.

Hybrid Model Benefit – 4

Fewer Responsibilities

As a Payment Facilitator, you’ll have to deal with increased PCI DSS compliance, fraud liability, and staffing requirements. Registered PFs also must meet legal regulatory and compliance requirements that verify the identities and legitimacy of prospective sub-merchants. As a Hybrid PF, your payments partner will handle all the tasks associated with this, including:

- Checking prospective submerchants against the OFAC (Office of Foreign Assets Control) and MATCH (Member Alert to Control High Risk) lists

- Determining sub-merchants’ financial conditions are acceptable according to your policy and recommended volume thresholds.

- Deciding what level of risk each sub-merchant posesEnsuring sub-merchants are in the same jurisdiction as the acquirer

Hybrid Model Benefit – 5

The Same Fast, Frictionless Onboarding

As a Hybrid PF, you can offer your customers the same fast, frictionless onboarding as a regular PF. Working with a payment provider like Clearent allows you to instantly underwrite and onboard accounts through a Boarding API for immediate card acceptance, seamlessly embedding payments onboarding into your existing account setup process.

Clearent’s Hybrid PF model removes the barrier to entry for many SaaS providers. You can take advantage of all of these benefits, including complete control over the platform and the user experience, without being held liable for the majority of risk and responsibilities related to operational expenses, chargebacks, underwriting and PCI DSS compliance.

Bottom line: a Hybrid PF model allows you to provide clients with high-value platforms for payment processing and reap increased financial rewards while staying focused on your brand and customers. Ready to become a Hybrid Payment Facilitator?

Article by Clearent by Xplor

First published: October 30 2019

Last updated: July 25 2024