The idea of merchants offering their customers a discount for paying with cash or check is nothing new. Neither is adding a fee to cover the cost of processing credit cards. Sharing your processing fees with your customers makes a lot of sense, and with the rapidly changing payments industry, we’re seeing a huge surge in popularity around cash discounting with dual pricing and surcharging.

The trickiest part of making these types of programs work for your business is knowing your options. In this post we break it down and give you a clear look at the advantages of each option.

So, what’s the difference?

Cash Discounting

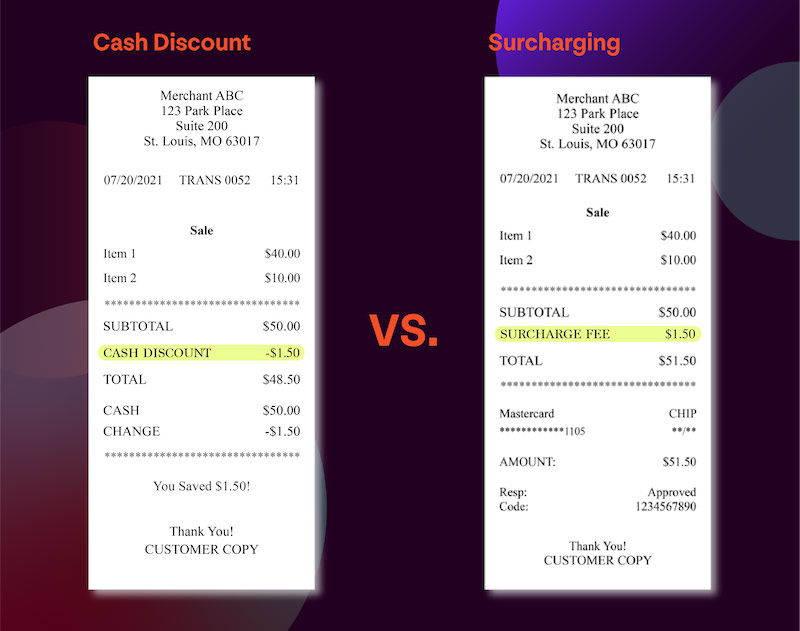

A True Cash Discount is when a business offers a discount to customers who pay by cash, check or store-branded gift card, instead of with a credit or debit card. If you currently take credit card fees into account when pricing your products and services, cash discounting is simple.

As long as those prices are posted, you can offer a discount to customers who pay with cash. You can set the size of the discount to the amount that you choose, even if it’s higher than your cost of accepting credit and debit cards.

Business owners are required to display signage at the entrance of their business and at the point of sale and should also post both the cash price and the card price of each item so there is no confusion about how much an item costs.

Dual Pricing

Dual pricing part of a solid cash discounting program. Dual pricing is when both list and cash prices for items are shown clearly on display. Customers who pay by card pay the list price. Customers who pay by cash, check or gift card pay a discounted cash price. Dual pricing shows both list and cash price on terminal, inventory and on customers’ receipts.

Dual pricing allows businesses to enhance customer value and improve customer engagement by allowing customers to pay with a tender that works best for them.

When implementing dual pricing, businesses should strive for transparency, fairness, and ethical considerations in their pricing strategies.

Surcharging

Surcharging is when a business owner applies a fee to a customer who pays with credit. However, if you want to apply a surcharge to your customers’ transactions, there are a few extra steps to pay attention to. You need to notify the card brands 30 days before you begin a surcharging program and follow their specific standards regarding Surcharging to stay compliant, which includes registering with Mastercard.

It’s important to note that Surcharging is prohibited in five states: CT, ME, MA, NY, and OK.

Is it worth it?

These programs result in real profits that you can reinvest in your business and watch it grow. For example, Clearent on average saves business owners $13,000 a year in credit card processing fees. Clearent customer’s projected credit card processing fees savings are $144 million per year.

How do I pick the best program for my business?

Before you decide which program is right for your business, it’s a good idea to keep a few things in mind when weighing the pros and cons.

- Not all customers carry cash. Depending on the type of customer, they may prefer to pay with credit or debit cards.

- Cash can mean a greater security risk for small business owners as it can’t be as easily traced if it goes missing.

- However, cash keeps things simple. If your customers pay with cash, you don’t have to worry about fees or compliance.

- Most importantly, saving on card processing costs means you’ll have more money in your pocket at the end of each month to reinvest in your business!

Is it really that simple?

Actually, yes! Cash discounting with dual pricing and surcharging are becoming increasingly popular for several reasons, but mainly because they can greatly reduce your processing costs through very simple measures.

We’d give you two pieces of advice for success though. Clear signage will keep you compliant and consistent employee training will eliminate the majority of customer concerns.

Ready to get started? Click here to explore our programs.

Article by Clearent by Xplor

First published: February 28 2024

Last updated: October 17 2024