The way businesses handle payment processing costs has evolved significantly over the years. As transaction fees continue to impact profit margins, businesses are looking for ways to mitigate these costs while maintaining customer satisfaction. Two common approaches used are cash discounting and surcharging. These programs allow businesses to offset credit card processing fees, but they do so in fundamentally different ways.

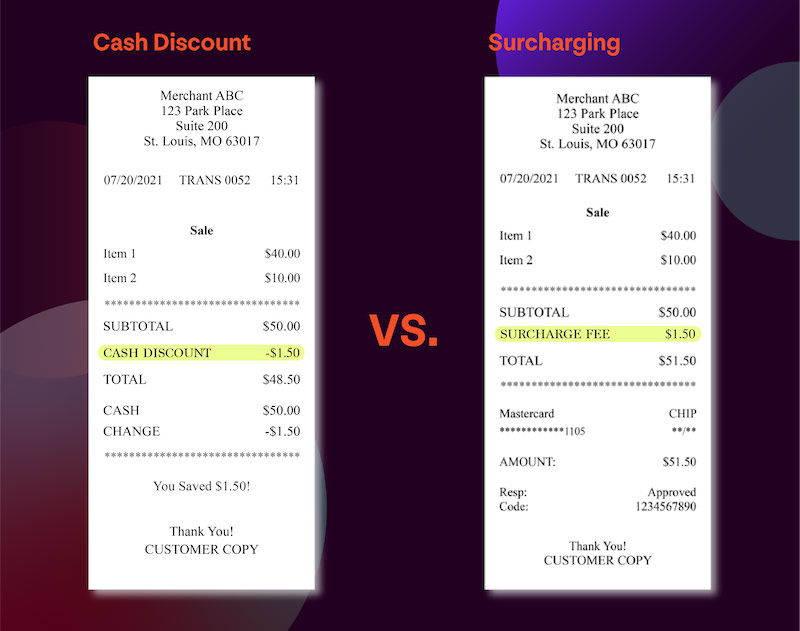

Cash discount programs incentivize customers to pay with cash by offering a lower discounted price from the standard cost, effectively passing on savings from reduced processing fees. On the other hand, a surcharge program adds a fee to credit card transactions, directly shifting the cost of processing onto the customer who chooses that payment method.

In this article, we’ll break down these two models, highlight their benefits, and help you determine which approach best suits your business needs.

So, What’s the Difference?

Cash Discounting

A cash discount program is a pricing strategy where businesses offer customers a discount for paying with cash instead of using credit or debit cards. Unlike surcharging, which adds a fee to card transactions, a cash discount encourages customers to choose lower-cost payment methods while making it easier to comply with card network rules.

Many businesses naturally factor payment processing fees into their product and service pricing. A cash discount program works by passing on the built-in savings directly to customers who choose to pay with cash. This system is particularly beneficial for small businesses looking to manage operating costs efficiently while maintaining transparency with customers.

Benefits of a Cash Discount Program

- Reduced Processing Fees: Credit card processing fees can add up quickly, cutting into profit margins. By incentivizing cash payments, businesses reduce their reliance on card transactions, minimizing these costs.

- Increased Profit Margins: With fewer transactions subject to processing fees, businesses retain a larger percentage of revenue, allowing for reinvestment in operations, staff, or expansion.

- Simplified Transactions: Cash payments eliminate potential chargebacks, fraud risks, and processing delays, making transactions smoother and reducing administrative burdens.

- Customer Incentives: Offering a discount for cash payments can improve customer satisfaction, as buyers perceive added value when they save money on purchases.

- Compliance and Transparency: When implemented correctly with proper signage and pricing adjustments, cash discounting remains fully compliant with legal requirements and card network policies.

Is Cash Discounting Right for Your Business?

A cash discount program can be a game-changer for businesses looking to save on processing fees and increase their bottom line. However, success depends on the type of business, customer preferences, and effective program implementation. If your business has high credit card processing costs that eat into profits, a customer base that frequently uses cash, and a willingness to implement clear signage and pricing transparency,a cash discount program may be an excellent option for reducing costs and maximizing profitability.

Dual Pricing

Dual pricing is part of a solid cash discounting program. Dual pricing is when both list and cash prices for items are clearly displayed. Customers who pay by card pay the list price. Customers who pay by cash pay a discounted cash price.

Instead of a single price being displayed with a discount applied at checkout, businesses present two clear prices upfront: one for cash payments and another for credit card payments. Dual pricing shows both list and cash price on the terminal, inventory and on customers’ receipts. This ensures that customers are fully informed about their payment options before making a purchase.

Key Benefits of Dual Pricing:

- Enhanced Transparency: Customers see both prices ahead of time, reducing confusion and increasing trust.

- Clear Receipts: Printed receipts explicitly show the price difference, reinforcing credibility.

- Stronger Customer Relationships: Businesses can present cash discounts as a benefit rather than a penalty for card usage.

By implementing dual pricing effectively, businesses can provide better customer experiences and manage costs efficiently.

Surcharging

Implementing a surcharging program is a pricing strategy in which businesses pass the cost of credit card processing fees onto customers who choose to pay with a credit card. Unlike cash discounting, which rewards customers for paying with cash, surcharging adds a fee specifically to credit card transactions.

Benefits of Surcharge Programs

- Offset Processing Costs: Businesses can pass credit card processing fees directly to customers, reducing overall expenses.

- Increased Profit Margins: By eliminating processing fees from their expenses, businesses retain more revenue.

- Encourages Alternative Payments: Customers may be more inclined to use cash or debit cards, which have lower fees.

- Transparency in Pricing: With proper signage and communication, surcharging can be a clear and fair way to handle credit card fees.

It’s important to note that surcharging is prohibited in a few states. Be sure to check updated guidelines for your state.

Is it worth it?

These programs result in real profits. For example, Clearent by Xplor saves business owners $144 million a year in credit card processing fees. This breaks down to an average of $13,000 a year per business simply by sharing their processing costs with their customers.

How do I pick the best program for my business?

Before you decide which program is right for your business, it’s a good idea to keep a few things in mind when weighing the pros and cons.

- How Do I Pick the Best Program for my Business?

- Before you decide which program is right for your business, it’s a good idea to keep a few things in mind when weighing the pros and cons.

- Not all customers carry cash. Depending on the type of customer, they may prefer to pay with credit or debit cards.

- Cash can mean a greater security risk for small business owners as it can’t be as easily traced if it goes missing.

- Cash keeps things simple. If your customers pay with cash, you don’t have to worry about fees or compliance.

- Most importantly, saving on card processing costs means you’ll have more money in your pocket at the end of each month!

Is it Really That Simple?

Yes! Cash discounting and surcharging are effective strategies for reducing processing costs. With the right approach, proper signage, and clear employee training, businesses can maximize savings while maintaining a positive customer experience.

No matter which option you choose, ensuring compliance and maintaining transparency will be key to success. By educating your customers and implementing these programs effectively, you can keep more of your hard-earned revenue and reinvest in the growth of your business.

Ready to see how Clearent by Xplor can help you decide if Cash Discounting or Surcharging is right for your business?

Disclaimer: The information provided in this communication does not, and is not intended to, constitute legal advice and is provided for informational purposes only.

by Clearent by Xplor

-

First published: February 28 2024

Written by: Clearent by Xplor