On April 12, 2024, we will update our systems to reflect the April association updates.

Visa

Visa System Integrity Fee Billing Adjustments

Visa assesses System Integrity Fees on declined transactions under certain conditions, including:

- Transactions that are retried after the issuer has previously declined with a reason code indicating that they will never approve, such as when the card account is closed

- Excessive retries on declined cards

These fees are known as Never Approve Reattempt and Excessive Decline Reattempt and are $0.10 per domestic transaction and $0.15 per international transaction.

Billing for these fees will be applied in April and will be reflected in merchant statements and partner residuals where applicable.

Changes to Small Merchant Program Fee

Visa is modifying the qualification criteria for card-present small merchant credit transactions. Transactions containing a surcharge or transaction fee will not be eligible for small-merchant rates on card-present transactions. This will apply for the following merchant segments: Restaurant, Taxi, Real Estate, Education, Healthcare, Advertising, Insurance, and Services.

Interchange Program Rates Modified

Visa is modifying rates for certain fee programs that apply to Visa consumer credit transactions.

The following table shows the select existing Visa consumer credit fee programs applicable to transactions from eligible small merchants with updated rates.

Mastercard

Mastercard is introducing a “Mail Order-Telephone Order Fee” of 0.015% based on the volume for both Domestic and Cross-Border transactions.

Mastercard is also updating their Digital Enablement Fee for transactions greater than or equal to $1,000.00. Previously this fee was capped at $0.20 but will now be a fixed amount of $0.40.

As a reminder, the Digital Enablement Fee for transactions less than $1,000.00 is 0.02% times the value of authorization, with a minimum of $0.02.

Mastercard is also increasing their Acquirer Brand Volume fee (also known as Assessments) by 1 basis point, or 0.01%. See the table below.

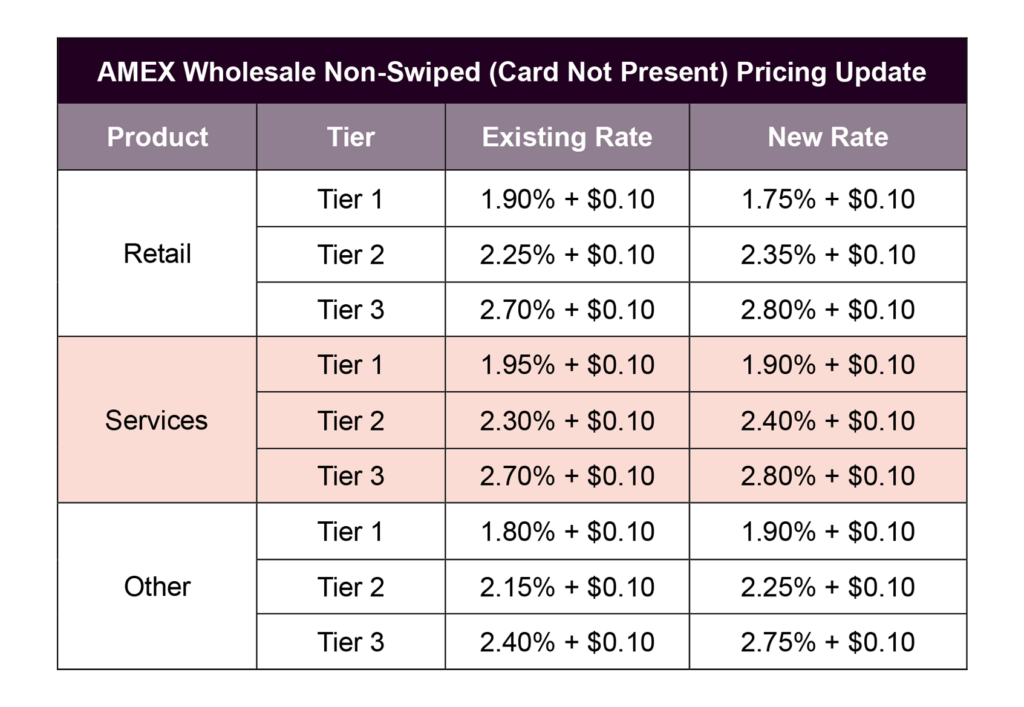

American Express

American Express is updating their interchange rate for Retail, Services, and Other within their Wholesale Pricing. This will apply to their Card Present and Card not Present transactions.

Below is the pricing update for the Card Present transactions.

Below is the pricing update for the Card not Present transactions.

Article by Clearent by Xplor

First published: August 31 2023

Last updated: April 05 2024