If your SaaS business is suffering from poor user retention, you’re not alone. Subscription churn is a common issue for SaaS providers at all stages of growth. Correcting it might seem like a big undertaking, but it is one worth prioritizing.

Even just a 5% increase in retention can increase profits from 25% to 95% according to recent studies at Bain & Company. Before we dive into common reasons for customer churn, let’s review the definition.

Customer Churn Definition

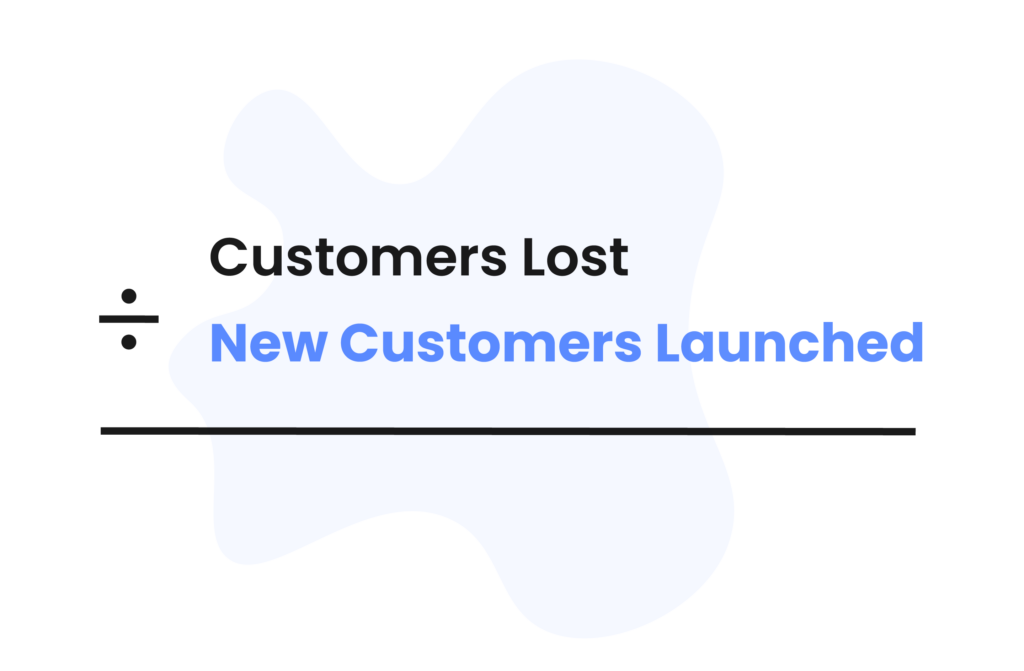

Customer churn refers to the percentage of customers that ended the use of your service or products during a defined time period. It is commonly calculated by dividing the number of customers you lost in a quarter by the new customers you launched during that same period.

Common Churn Causes & Solutions

PRICING

Challenge: Most users have a ‘use it or lose it’ mentality when it comes to business applications or technologies of all types – payments included. Conversely, if your customers use your technologies and payments integration often and find everyday value in it, they will pay a premium for it.

Solution: That’s why every sale should be made on value. The more educated your customers are about the benefits of your software and payment integration, the less price sensitive they will be. Processors with advanced ISV partner programs will help you determine your unique value propositions, deliver co-branded materials, and help you launch an educational GTM strategy that builds trust and awareness with customers at every turn of the buyer’s journey.

TECHNOLOGY

Challenge: Nowadays, there are endless ways to accept payments, but not all of them will make sense for your customers and their business flow. If customers are churning, this could signify a sales gap where sales teams have been incentivized to hit quotas and push new technologies with little or no emphasis on customer fit.

Solution: Interview your best customers or send out surveys to determine their top feature and functionality requirements. Armed with this information, you can work with your payment processor to adjust your technology stack. Once perfected, it is critically important that you take the time to align quotas with customers’ needs ensuring true alignment and fit for all parties. If you are leveraging your processor for sales, be sure to set proper expectations with their support teams so you can set the tone together and reach your goals in a way that’s clear for everyone.

STABILITY

Challenge: Users crave an Uber or Amazon-like experience for, well, everything. This means your user experience needs to not only be stable, but should also deliver a seamless experience across every avenue where a payment can take place. If you are working with a payment processor whose gateway frequently goes down, has feature glitches, or processes payments at a snail’s pace, it’s time to find another partner.

Solution: When you interview new payment providers, be sure to dive deep into past issues that you’re looking to resolve. Talk through your customer’s current needs and your vision for the future. Great payment processors will support you in this journey, offering various roadmaps and a phased approach to adoption so you can test, launch, and scale payments at a pace that makes sense for your business and your customers.

ONBOARDING & SUPPORT

Challenge: In addition to a technically sound experience, customers want to feel welcomed and valued by the businesses they support. Anything less will cause attrition.

Solution: To solve this issue, make sure you understand your customer onboarding and support experiences end-to-end. Going through this exercise with your processor will ensure expectations are aligned and there are no gaps in the handoff process. The best processors offer a single point of contact that stays with your account throughout the length of your partnership to ensure there is a tight-knit feedback loop – allowing you to go to market faster and more efficiently. Giving your customers solid documentation and access to a reliable support team is also an important part of the community-building process. If this area is lacking, you can be sure that you are leaving money on the table.

ADDITIONAL VALUE

Challenge: The payments industry is saturated. We get it. The best way you can ensure that your integration doesn’t add to the noise is by ensuring it makes customers more efficient and profitable despite changing market conditions.

Solution: One way we’re seeing ISVs help their customers increase their profitability is by offering surcharging, convenience fees, or cash discounts on their platform. These enhanced pricing strategies are growing in popularity. They can help small businesses eliminate thousands of dollars in annual credit card processing fees by passing these costs along to customers simply and securely.

Conclusion

In the SaaS business, some customer churn is expected, but if you are noticing a constant uptick in attrition it’s time to give your payments integration a second look. There are many onboarding, pricing, support, or technology adjustments that can be made to improve your payment attachment rates. If you are struggling with any of these issues, connect with us. We’d love to talk through the options that have the biggest impact on your bottom line

by Clearent by Xplor

-

First published: April 13 2021

Written by: Clearent by Xplor