Recently I had the opportunity to chat with Murali Nethi, founder and CEO of Hana Software and SnapBlooms.com. Hana is a software company which offers business management solutions to more than 575 retail flower shops in the U.S. and Canada. SnapBlooms.com is the e-Commerce flower delivery platform Nethi and his wife launched earlier this year. To learn more, you can view a recording of conversation or read the summary of the successes below.

Tell us about Hana Software and how you got started in the industry.

In 2010, my wife actually had a flower shop for a brief time. We saw how the technology gaps with older floral POS systems made it difficult for independent florists to compete with big flower companies and other competitors in their area. That’s what got us started on this solution and why we say that Hana Software is a floral POS system developed by florists for florists.

What challenges did you face around payments that prompted you to explore other solutions?

Before we integrated with Clearent, we were going through multiple payment gateways, like Authorize.net. And obviously, there are a lot of challenges with payment gateways, including that it adds an extra step to the onboarding process.

For example, for every client that you onboard, you have to educate them about the payment gateway. You have to explain what a payment gateway is, how much it costs, and then explain that the payment gateway is not something that Hana is tagging on.

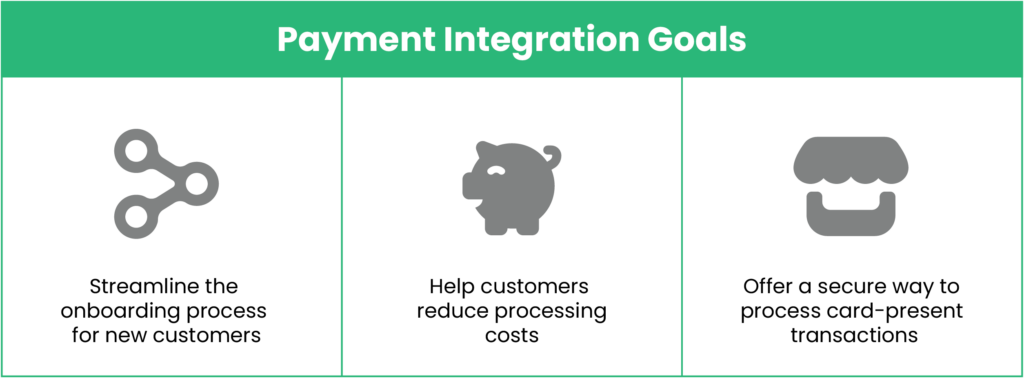

And then, if they don’t understand, we have to talk to their credit card processing company, negotiate with them and then get them set up. So there’s a lot of time involved, and time is extremely valuable for a software vendor. By embedding payments directly into your software, you can streamline this process.

In addition to simplifying the onboarding process, eliminating the payment gateway also helps our clients reduce their costs. It also allows them to offer more payment options, and do so safely and securely.

For example, when our clients use a payment gateway, they are unable to process card-present transactions in the most secure way, which is by dipping an EMV-enabled chip card into a smart card reader. Most of these readers include NFC technology, which means they can process all state-of-the-art payment methods, including contactless payments and mobile wallets, such as Apple Pay and Android Pay.

What attracted you to Clearent?

We were approached by many different payment processors while looking for a partner for integrated payments. The major difference with Clearent was their approach and communication.

”We really liked their approach. They were open and honest and we were able to talk to the right person and get all the answers. That gave us the confidence that this was the right partnership for our payment integration.” – Murali Nethi, Founder & CEO Hana Software & SnapBlooms.com

They were very upfront and very transparent. It was not like a sales call. It was more like a partnership and a discussion with a solution provider. I could tell they were truly trying to solve the problems we were facing.

How has your payment integration impacted your customer experience?

The major thing that we noticed is our onboarding process is now a lot smoother and faster. We can now easily tell customers what happens next, these are your options, and this is exactly how it works.

To be more specific, it used to take four weeks to onboard a new customer. Now it only takes one week. This can mean the difference between having a customer and not having a customer as florists are very seasonal businesses.

So the communication of the rate, the communication of the payment processing method, and the onboarding becomes easier. And they get the benefit of the integration, and don’t have to enter information multiple times into different systems.

What other benefits have you experienced?

In addition to the benefits listed above, our clients can now securely store credit card information on file for future use thanks to Tokenization. Knowing that Clearent is securely storing sensitive card data removes a huge burden for us as a software vendor in terms of PCI scope.

At a high level, integrated payments have helped us grow our customer base by 15% and increase retention by 20%, all while creating a new revenue stream for our business.

How have your customers responded to the option of using integrated payments?

Being able to offer integrated payments is a true value add for our software, and our customers appreciate the benefits. That’s why integrated payments aren’t mandatory, and we don’t actually sell. We simply tell our customers this is what we have and these are the benefits. About 90% of our customers just go with Clearent because it’s a no-brainer. We give them the benefits and higher payment attachment rates naturally happen.

What has impressed you the most about Clearent?

The biggest difference with Clearent is that they are more willing to listen to their partners and are open to suggestions. Another major thing that Clearent should be very proud of, compared to other payment processors, is that they are very hands on. Not only is Clearent our partner for payment processing, but they actually help us drive sales. From assisting with marketing efforts to leveraging their call center to reach out to customers, Clearent has created a true, mutually beneficial partnership.

Do you have any special projects on the horizon?

Earlier this year we launched our marketplace for flower shops called SnapBlooms.com. We expect that platform to grow and are planning to add around 600 flower shops a year. Clearent is going to be an integral part of that solution. Any florist who joins our marketplace will securely process payments through Clearent, which will multiply our processing volume and residuals, while providing even more value for our customers.

Curious how integrated payments can increase the value of your software while boosting your bottom line? Click here to learn more.

by Clearent by Xplor

-

First published: September 20 2021

Written by: Clearent by Xplor