Picking the Perfect Payment Processing Solution

When picking the perfect payment processing solution for your business, many merchants have questions about which processor is right for them and what the difference is between all of the choices out there. If you need some guidance, we’re here to help you get the info and insights you need.

Clearent and Square are two major players in this game, and they offer services that can be tailored to your specific needs. In this article, we’re going to break down Clearent and Square to help you figure out which one is the best fit for your business. They both have their strong points, and we’re here to help you make the smart choice.

Key Selling Points for Clearent vs Square

- Personalization: Clearent’s solutions are crafted to meet the unique needs of each merchant, ensuring a personalized and effective payment processing experience.

- Industry Expertise: Clearent provides customized solutions designed specifically for specialized markets, leveraging their deep industry knowledge to cater to the unique requirements of various businesses.

- Integration Flexibility: Clearent offers seamless integration with various POS systems and software, giving merchants the flexibility to connect with their preferred tools and optimize their payment processes.

- Emphasis on Security: Clearent places a strong emphasis on data security and compliance, offering a robust commitment to safeguarding sensitive information and ensuring merchants meet industry standards for secure payment processing.

- Advanced Reporting and Analytics: Clearent offers more advanced reporting and analytics tools, allowing merchants to gain deeper insights into their transactions and customer behavior. This is beneficial for businesses looking to fine-tune their operations and make data-driven decisions.

- Cost-Effective Pricing: Clearent’s pricing can offer cost savings, particularly for businesses with higher transaction volumes and specific requirements, making it a competitive choice when compared to Square’s standardized flat-rate pricing.

- Unparalleled Security: Security is a top priority for Clearent, achieved through encryption, tokenization, and strengthened gateway security. With Clearent’s Empower Program, you can ethically share credit card processing costs with customers, achieving substantial savings for business growth.

- A Traditional Approach: At Clearent, we tend to be the go-to option for businesses with experience and those just getting started. Clearent is designed with businesses that have been around the block in mind, making it a top pick for those with more complex financial needs.

- Scalability: Clearent is well-equipped to scale up, providing advanced reporting and enhanced features that align with the growth strategies of small, large, or expanding businesses.

Key Selling Points for Square

- Simple Payments: Whether it’s in your store, online, or on the fly with your phone, square offers quick and secure transactions without any headaches.

- User-Friendly Interface: Square’s software is designed to be a cinch for everyone, ensuring that you and your customers won’t get stuck in confusing features. It’s hassle-free for everyone.

- Inventory Tracking: Square’s software includes inventory tracking tools that enable merchants to manage their products effectively. They can track stock levels, set up alerts for low inventory, and streamline the reordering process.

- Know Your Business: Square gives you insights into how your business is performing. See what’s selling and who’s buying, helping you make smart decisions.

- E-commerce Integration: Square seamlessly integrates with e-commerce platforms, enabling merchants to expand their online presence and reach a broader audience.

- Security Measures: Square prioritizes data security, implementing encryption and fraud protection to safeguard customer information and payment data.

- Scalability: Square’s software is adaptable and can work with businesses of all sizes, whether a merchant is a small startup or a large enterprise. Square, can accommodate their needs.

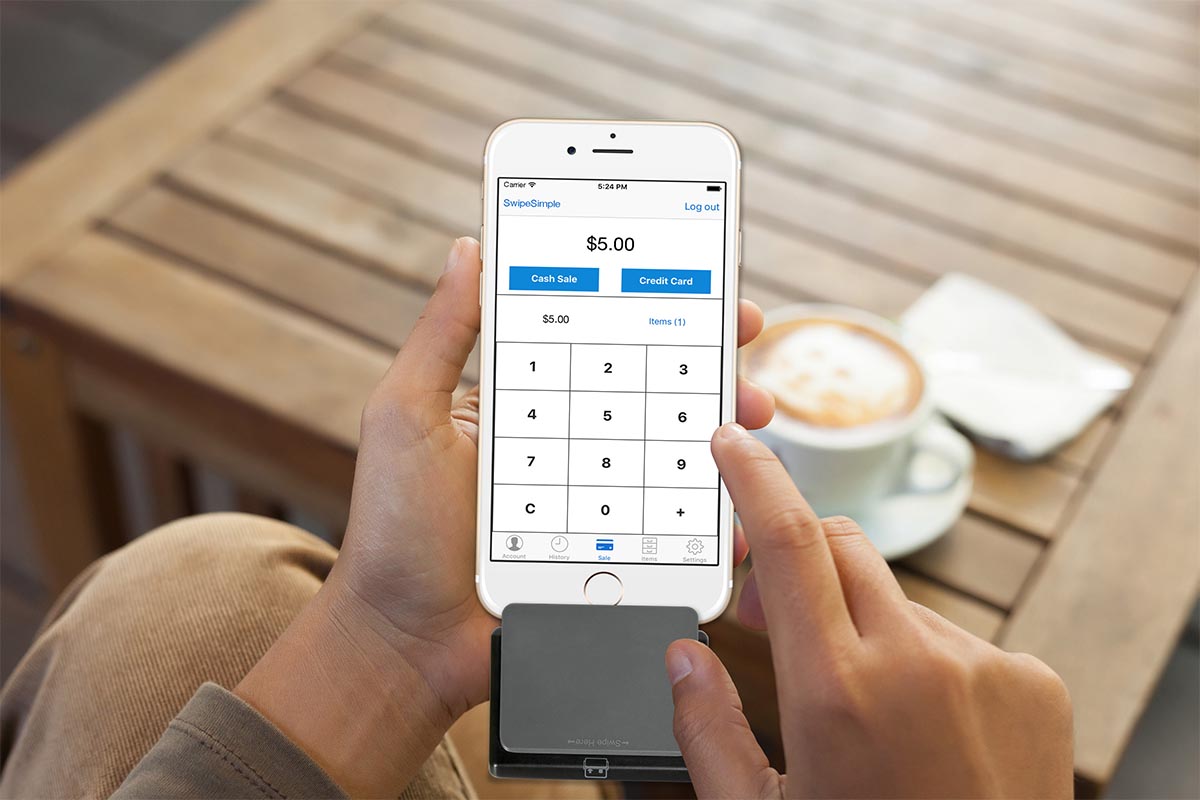

- Mobile Payment Solutions: Square excels in mobile payment processing, making it suitable for on-the-go businesses and those looking for versatile payment options.

- Straightforward Pricing: Square keeps it simple with pricing that’s easy to understand, helping merchants avoid unexpected fees or long contracts.

- Fast Access to Money: Merchants appreciate that Square gets their money to them quickly, often within just a couple of days, which helps with their cash flow.

- Payment Flexibility: Square’s tools work for all kinds of businesses, whether you’re in a store, on the go, or online. It’s versatile, making it easy to accept payments in different ways.

- Helpful Insights: Square provides merchants with useful data and reports to see how their business is performing.

Ultimately, merchants should evaluate their specific business needs and goals to determine which provider aligns best with their strategy.

Clearent and Square differ primarily in their payment processing models and target markets. Clearent offers traditional merchant account-based processing with customizable pricing, making it suitable for medium to large businesses seeking tailored solutions. In contrast, Square employs a simplified flat-rate pricing structure and serves primarily small businesses, startups, and solo entrepreneurs. Square’s ecosystem provides a suite of integrated business tools, while Clearent primarily focuses on payment processing. The choice between them hinges on business size, complexity, and the need for supplementary services, with Clearent catering to larger enterprises and Square being a user-friendly choice for smaller businesses.

At Clearent, we understand that choosing the right payment processing solution can be a complex decision. We’re here to help guide you through this process. Our team can perform a comprehensive rate analysis to show you just how much you could be saving with Clearent.

Don’t hesitate to reach out to us today for expert advice and personalized assistance in optimizing your payment processing. Let’s boost your business together.

by Clearent by Xplor

-

First published: April 05 2023

Written by: Clearent by Xplor