It has been six months since the first laboratory-confirmed case of COVID-19 in the U.S. was reported to the Centers for Disease Control and Prevention. Since that fateful day, people have been wondering, ”When will things return to normal?” While no one knows the answer to that question for sure, one thing is certain. Our country, and our world, will definitely look different post pandemic.

COVID-19 has impacted all areas of our lives, from how we work and learn to how we travel and interact with others. It has also had a dramatic impact on how we shop and pay for goods and services. Consumers are increasingly turning to payment options that help them avoid cash and contact with others as well as reduce their exposure to frequently-touched surfaces. This shift has caused business owners to seek out additional ways to safely accept in-store and digital payments, including:

- Online and in-app purchases

- Payments made through secure links received either via text or email

- Payments made over the phone

- Purchases made with a contactless credit card or mobile wallet, (e.g., Apple Pay, Samsung Pay, Google Pay)

In this post I would like to dive into contactless payments, which allow consumers to simply tap to pay. Contactless payments have had a relatively slow start in the U.S., in comparison to other countries, like Europe, Canada and Australia. However, that is quickly changing due to COVID-19.

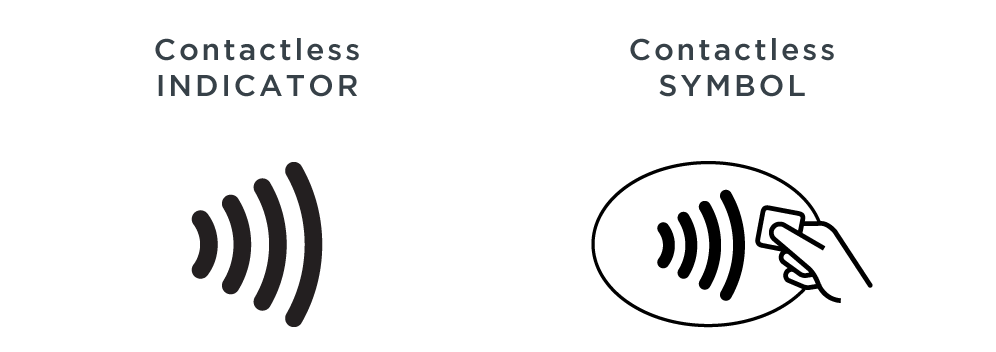

Contactless payments can be made with a contactless credit card or with a digital wallet on a smartphone, smartwatch or tablet. Contactless-enabled credit cards have a contactless indicator on them. These cards are then used at payment devices which have ”Near Field Communication” (NFC) capability, which is often represented by the symbol below.

With NFC, no physical contact between the payment device and the payment reader is necessary. Consumers simply hold their card, mobile wallet or smart device no more than 1-2 inches away from the contactless symbol on the terminal.

Contactless payments are fast, easy and secure. Through a process called tokenization, a one-time code is created that protects consumers’ payment information. Point-to-Point Encryption (P2PE) is then used to protect sensitive cardholder data as it moves through the payment system.

Here are some interesting statistics about the growth of contactless payments.

- According to Mastercard, more than half (51%) of Americans are now using some form of contactless payment, whether it be a contactless credit card or mobile wallet.

- Visa reported that 31 million Americans tapped a Visa contactless card or digital wallet in March 2020, up from 25 million in November 2019, and up 150% from March 2019.

- According to American Express, 58% of consumers who have used contactless say they are more likely to use contactless payments now than before the outbreak of COVID-19.

- Visa reported that the U.S. now has 175 million contactless cards, which is more than any other global market. Nine out of the top 10 U.S. card issuers are actively rolling out new contactless cards to their customers.

Research clearly shows that consumer preferences are shifting toward contactless payments, and that change is here to stay. This is especially important if you are a small business owner and are not set up to accept contactless payments. We offer a full range of contactless terminals, but want to remind you that contactless payments are just one piece of the puzzle. To survive the pandemic and thrive long term, businesses need to offer multiple touch-free payment options. This way customers have multiple options to safely make payments in-store and online.

If you are a business owner and would like to discuss your payments strategy, please contact us. We would love to hear more about your business and share how we can help you grow by adding new payment channels and creating a better customer experience.

by Clearent by Xplor

-

First published: July 20 2020

Written by: Clearent by Xplor